Ever seen a founder walk off Shark Tank with no deal, then outsell most winners? Here’s where reality shreds TV hype—because getting on that stage is just the warm-up. MealEnders walked in pitching willpower-in-a-lozenge. By the time the cameras cut, most folks missed the real story: what happens when you mix one gutsy founder, $1.4 million in sales, a pile of personal cash, and the most skeptical Sharks in the tank.

Want to know what works, what stings, and what you’d never see unless you were hustling these waters yourself? Let’s cut through the noise.

Contents

ToggleWhat MealEnders Was: Smart or Smoke?

MealEnders didn’t claim to be magical fat-melters. That’s key. Founder Mark Bernstein spotted a sly flaw in how our brains process fullness. We eat, but that I’m done signal takes a while to hit. So, the pitch: a lozenge with a sweet, rewarding shell and a wild, tingly (some say straight-up weird) center. You pop one when you finish eating. The idea? Distract your mouth, let your brain play catch-up, and stop that just one more forkful habit.

No pseudo-science. No appetite-suppressant chemicals. Just sensory trickery with a dash of behavioral psychology.

I’ve sat across too many founders who wish tech alone could solve habits. Bernstein actually chased a human insight. That’s the kind of thinking that gets me interested.

The Pitch: High Stakes, Serious Money, and a Dash of Nerve

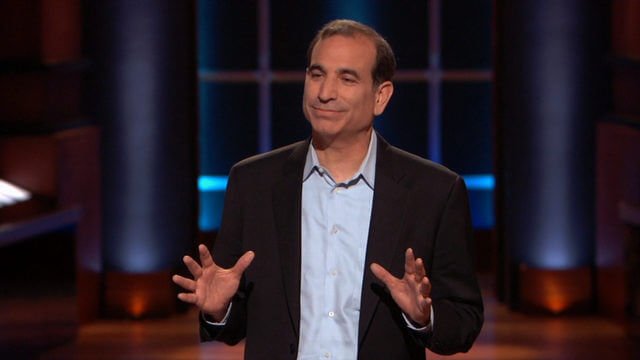

Let’s talk business reality. Bernstein strode into Season 8, Episode 19, looking for $350,000 for 8%. If you’re counting, that’s a $4.375 million valuation. Steep for a product that’s basically an advanced after-dinner mint. But here’s the thing: the numbers told a different story.

He’d clocked up $1.4 million in sales in less than two years—most of it direct-to-consumer, no retail shelf help. That’s no fluke. He’d put in $200,000 of personal savings and pushed a $1.1 million convertible note to fuel growth. Toss in $85,000 monthly ad spend—it means Mark was swinging, not waiting for some Shark to do the legwork.

I’ve seen founders pitch big numbers to prove they’re serious. Sometimes it’s ego. In Bernstein’s case, it was calculated bravado: show strength, make the Sharks sweat.

Net Worth, Revenue, and the “Is This Real?” Test

By Shark Tank taping, MealEnders’ net worth—if you believe startup math—was near $4.3 million. Realistically, those $1.4M in sales count a lot more than most food fads flashed on TV. But where did it go after the show?

Here’s the kicker: SharkWorth reports MealEnders spiked to a sweet spot—$5 million annual revenue at peak. That’s more than a dozen other brands that got TV deals. Bernstein didn’t sell everything to the Sharks; instead, he put his chips on the Shark Tank effect. It paid out—fast.

So, was the net worth smoke and mirrors? Not here. When customers bite, returns stay ultralow (2%), and margins hold against crazy ad spend, that’s the kind of hustle founders should envy.

The Sharks React: Who Flipped, Who Fled?

Everyone loves quoting Daymond or Lori when they get starry-eyed, but real lessons come from what made them wince. Here’s the no-spin summary:

- Mark Cuban: Liked the idea, but called out the marketing. He said, If this was that good, it would have blown up by now.

- Robert Herjavec: Looked at the customer acquisition costs and ran for the hills—he’s been burned in the supplement war before.

- Kevin O’Leary: Actually admitted this was the one weight loss play he didn’t roast, but hated the cooling, menthol-ish core.

- Lori Greiner: Taste was a hard no for her; she couldn’t get past the lozenge’s weirdness.

- Barbara Corcoran: Loved it personally, but wasn’t about to write a check for the endless cash VACUUM Bernstein’s scaling would need.

Translation? Every Shark saw something they liked—and a problem they didn’t want to fix. That’s how you know it isn’t just about the pitch. It’s the messy middle of consumer business that gets scary.

After Shark Tank: The Rollercoaster Is Real

Most folks assume: No deal = no shot. That myth’s bigger than any Shark’s ego.

MealEnders smashed that notion. After its episode aired, sales blew up. Mark chased the DTC (direct-to-consumer) dream hard—Amazon, his own site, partnerships. If you want proof a Shark Tank bump can seed real scale, here it is. He kept churn ultra-low, found loyal fans, and rode digital marketing strategies most food startups only dream about.

The problems rolled in when operational chaos hit between 2021 and 2023. It wasn’t a marketing fail. It was supply chain hell that squeezed MealEnders. Source disruptions, shipping messes, ballooning costs—these aren’t TV drama; they’re real world business storms. By early 2023, MealEnders quietly shut down.

I’ve watched plenty of brands outgrow their infrastructure. Once your backend breaks, even the best pitch can’t save you.

Who Is Mark Bernstein? Founder Moves and Mindset

Let’s give credit where it’s due. Mark Bernstein was more than a clever product guy—he was a relentless scrapper. The $200K of his own cash, the chewing up of investor capital (a $1.1M convertible note, remember?), and the nonstop iterating—that’s a founder betting on himself, not the Tank.

I’ve known entrepreneurs who would’ve panicked under TV pressure. Bernstein doubled down and played long-game offense. His flaw? Maybe running too lean, too long. The lesson: every founder needs to know WHEN to muscle through and WHEN to upgrade operations. Bernstein got the demand right, but the logistics wrong.

Winners, Flops, and Lessons You Can Actually Use

MealEnders wasn’t built on hope and hype—it sold. That’s rare in health. Their wins?

- Real market traction before TV

- Sticky customer experience: 2% return rate is outrageously low in supplements

- Smart DTC push: skipping the impossible retail battle

- Enough confidence to say no to cheap offers—then cash in later

Mistakes? They matter, too:

- Heavy ad reliance: $85K monthly means you need deep pockets forever

- Product supply was fragile—one hit, it all toppled

- Too much on the founder’s shoulders: scaling physical products isn’t a solo sport

If you’re hustling your own play, here’s my two cents: test beyond launch, build operational strength, and never let your first viral moment lull you into comfort. The Sharks spot weak businesses miles away—they don’t have time to fix your fundamentals.

When the Pitch Room Hype Fades: What MealEnders Proves

Every founder dreams of a Shark Tank handshake. But don’t kid yourself: product/market fit and battle-tested logistics beat a six-minute pitch every time. MealEnders proves you can win—hard—after the Tank, but the pressure never fades. You’re chasing revenue in month one, solving supply headaches in year three.

So here’s the truth: What separates the true shark snacks from the guppies is how they survive the chaos after the big moment. Bernstein made a splash, surfed the wave, but the currents under the surface can wreck even the smart swimmers.

Want to build a business worth millions? Don’t just memorize pitches—study what happens next.

FAQs: The Raw, Short Answers

1. Is MealEnders Shark Tank still in business?

Nope. The lights went out in early 2023 after supply chain chaos knocked them out for good.

2. Where can I buy MealEnders today?

You can’t. The website is gone and most retailers have stopped listing. If you find it, it’s old stock.

3. Did any Shark invest in MealEnders?

No deal. Every Shark passed—some loved the concept, but no one opened the checkbook.

4. How much money did MealEnders make after Shark Tank?

Peaked at around $5 million annual revenue. That’s more than a bunch of actual deal winners.

5. Why did MealEnders shut down?

Supply chain breakdowns and cost overruns in 2021–2023. No product to sell means game over.

6. Did MealEnders actually help people lose weight?

Plenty of fan stories, but the lozenge manages urges—it’s a tool, not a magic fix.

7. How did Mark Bernstein fund before Shark Tank?

$200K from his own wallet, plus a huge ($1.1M) convertible note raise.

8. Can I start a similar business or is the market too crowded?

There’s always room if you outthink diets and solve the real pain. But supply, margin, and trust are now tougher than ever.

Long story short? Don’t fall for the TV ending. Real founders build in the struggle after the fame, and every dollar matters more than the applause.

If you want more raw breakdowns and the real math behind startups—bookmark SharkWorth. Because you don’t want just a flashy pitch. You want to own the messy, money-making middle.