They got a record Shark Tank deal, but did it actually change anything? Let me tell you: a big check and a round of applause on TV mean zero if your product can’t last. Let’s break down the real journey of Zipz Wine—because their story on Shark Tank wasn’t just flashy TV, it was classic high-stakes entrepreneurship with all the hustle, hype, and heartbreak built in.

Contents

ToggleOne Pitch, Big Glass

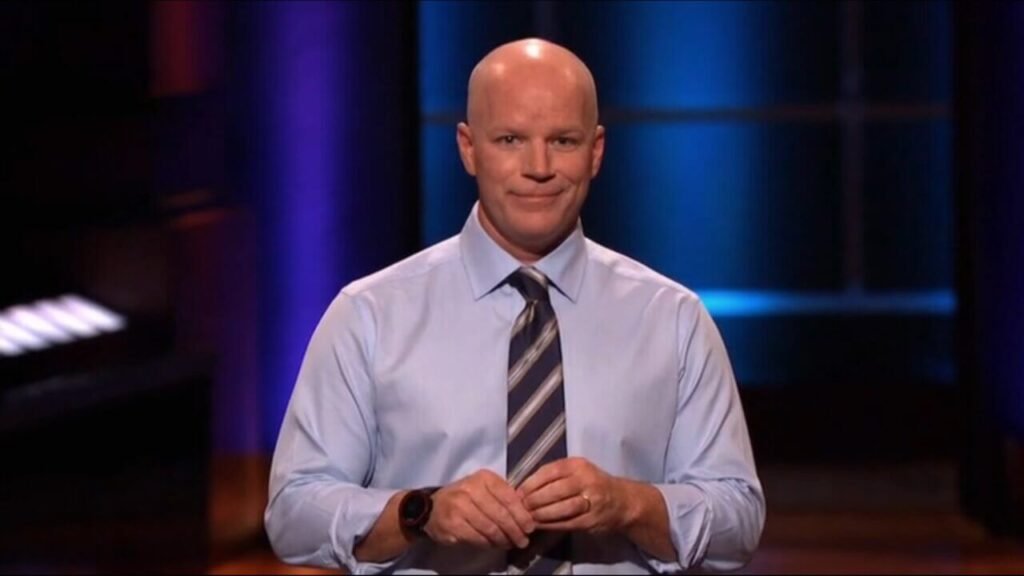

On Shark Tank Season 6, this wasn’t your typical invented it in my garage pitch. Zipz co-founder Andrew McMurray walked into the Tank bold, asking for $2.5 million for 10%. Most founders barely have the guts to pitch a million-dollar valuation. Here, McMurray wanted a $25 million shot—straight from a single-serve plastic wine glass. Everyone watched. Every hustler, every numbers guy, every dreamer with a wild idea.

Forget the overnight success fantasy. Zipz was a test: could packaging innovation, licensing, and a massive ask land the deal and actually live up to the pressure?

What Made Zipz Stand Out?

If you remember Copa Di Vino, you saw the early single-serve wine trend. But Zipz wasn’t just another pour. McMurray and his co-founder J. Henry Scott didn’t want to be a wine brand. They wanted to be the go-to for this patented plastic wine cup, shrink-wrapped, spill-proof, and UV-protected. The kind of thing you’d see at stadiums, airlines, or festivals where glass is a no-go.

Their secret sauce? Not the wine. It was the packaging. If you get licensing to pop, you’re not just selling units—you’re selling a concept over and over. That’s what gets VCs and Sharks excited: infinite scale, not slogging it out bottle by bottle.

I’ve seen founders get tunnel vision on their product. Zipz played the game smarter, building a play around packaging tech with those licensing hooks. On paper, that’s how you 10x a business overnight.

The Record-Setting Shark Tank Deal

You want TV drama? Nothing beats this: $2.5 million ask. The Sharks started calculating—and blinking—before the second zero was out of his mouth. So did you, admit it.

Kevin O’Leary is no fool with his money, but even Mr. Wonderful got seduced. He made Zipz the biggest Shark Tank deal at that point. He offered exactly what McMurray asked for, but with an added kicker—he lined up an extra option to double down: another 10% for another $2.5 million, potentially making the company worth $50 million.

Why did Kevin bite? Because, like I said, this had licensing cash cow painted all over it. It’s classic O’Leary: the percentage of every unit, the long play, the royalty stream. The other Sharks sat up straight. They didn’t want to be left out if this went Ball or Scrub Daddy status.

But do big deals always deliver? TV makes it look easy, but this is just the prologue, not the ending.

Zipz Wine Net Worth – Did the Math Add Up?

Let’s cut the hype and look at the numbers. McMurray slapped a $25 million valuation on Zipz. That raised eyebrows. You’d better have some serious revenue or assets at that level. Sharks want to see clear math, not just slide deck dreams.

On paper, Zipz looked like it could be the next Keurig for wine—massive possibility with the right distribution partners. If you can get stadium contracts, airline buy-in, or even a big-box shelf spot, it’s possible. But after the cameras cool down, the work begins—distribution, cost management, burn rate, and all the ugly parts you never see on TV.

What did the numbers look like once the Shark Tank glow faded? Reports (and whispers on SharkWorth) say the $2.5 million investment didn’t land like it should have. Once the initial buzz cooled, so did the valuation. Even with Mr. Wonderful’s money theoretically on the line, something just didn’t add up in the long run.

Could Zipz Scale After TV Buzz?

Let’s be real: flooding the market after Shark Tank isn’t a guarantee. You get a traffic spike, you get meetings, people call you back faster. But if you don’t have operational muscle and cash flow discipline, you’re toast.

Zipz immediately tried to leverage their deal into bigger partnerships and more robust licensing. Their pivot? Focus even more on selling the packaging, not the liquid. It’s what smart founders do: double down on what makes them unique.

But even with that, things started shaking. Reports hit that the business model was swinging hard. When you try to pivot this fast, you risk confusing your core customers—and burning cash while you do it.

From what I’ve seen—and what leaks out on sites like SharkWorth—it was a high-wire act. They lost product traction. The TV afterglow faded. Scaling stalled. This is the reality for most Tank startups, even the ones that sign monster deals.

What Went Wrong for Zipz?

Let’s not sugarcoat it: Zipz faced classic startup pitfalls, and then some. Here’s the blunt reality:

Business Model Swings: Too much shifting between wine, packaging, and licensing. Customers, and investors, got confused.

Cash Flow Crunch: If your burn outweighs your sales, no Shark Tank windfall can save you for long. Cash issues started to snowball as deals took longer, and margins shrank.

Market Vanish: The story goes—fall off the vine. One season, they’re hyped. The next, Zipz is vanished from shelves and online stores. The big promise just faded out.

Here’s the lesson: hype can make a company look bulletproof, but without tight business controls and focus, it’s just a sugar rush.

Is Zipz Still Pouring Wines?

Let me answer the question that every founder and Shark Tank fan wants to know. Is Zipz still alive? Are those single-serve glasses still showing up at stadiums, big box stores, or anywhere online?

Short answer: No.

By 2025, there’s little sign of Zipz Wine in the wild. The company isn’t running in its original form. The website is a ghost ship. Social accounts are dust. The only echoes of Zipz are on reruns and in post-mortems on sites like SharkWorth.

To anyone who believed in the dream, it stings. Was it the founders—Andrew McMurray and J. Henry Scott? The licensing shift? Cash burn? Maybe all three. In the end, the company that landed the biggest deal in Shark Tank history fizzled, quick and quiet.

Lessons for Entrepreneurs – Hype vs. Reality

So here’s what every founder, side hustler, or deal-chaser should burn into their playbook from Zipz’s Shark Tank saga:

1. TV Deals Aren’t Money in the Bank:

A handshake and a camera pan don’t mean your bank account is getting filled. These deals fall apart all the time.

2. Big Valuations Come With Big Scrutiny:

If you set your valuation sky-high, you better have the growth rate and assets to match. Sharks will dig deep. You can’t bluff forever.

3. Licensing Isn’t a Silver Bullet:

It’s sexy on paper, but complex in reality. Other companies have pulled it off (look at Scrub Daddy’s licensing spin-offs), but most don’t have the operational bandwidth.

4. Pivot, But With Precision:

Moves like shifting from product to platform, or direct sales to licensing, only work if you execute with conviction and clarity. Otherwise, you lose both your vision and your customers.

5. Cash Is Always King:

No amount of Shark Tank exposure makes up for weak cash flow management. Burn too fast, and you’re history.

6. Momentum Dies Fast:

Post-show buzz buys you six months, max. After that, it’s pure grind—sales, fulfillment, and real market feedback.

I’ve seen founders ride the Shark Tank wave, get press, nab early deals—and then crack under pressure. Only a few, like Bombas or Squatty Potty, turn their 15 minutes into a real business. Zipz couldn’t sustain the heat.

Conclusion: Fast Deals, Faster Fades

Here’s the raw truth: Shark Tank can change your life—or make your fall ten times louder. Zipz had swagger, innovation, and headline-making capital. But big egos, high-risk pivots, and a reliance on TV hype won’t replace relentless execution and staying obsessed with your customer.

If you’re pitching next season, remember Zipz. Don’t just aim for the camera. Aim for sticky, sustainable business. Sometimes, the gameshow gloss hides the grind—and that’s what separates the real players from the footnotes.

FAQs About Zipz Shark Tank

1. Is Zipz Wine still in business after Shark Tank?

No. As of 2025, Zipz Wine appears to have shut down or at least vanished from mainstream retail and online stores.

2. Did Kevin O’Leary complete his investment in Zipz?

Reports suggest the $2.5 million deal with Kevin O’Leary did not fully go through. It ran into issues post-show.

3. What happened to Zipz Wine after the show?

Zipz tried to shift their model, but struggled with traction, cash flow, and disappeared from the market after their initial boom.

4. Why did Zipz disappear from store shelves?

Too many pivots, cash troubles, and a fading afterglow from Shark Tank left them unable to keep products in stores.

5. How much was Zipz worth on Shark Tank?

Zipz was valued at $25 million during their Shark Tank pitch.

6. Is Zipz available online or in stores now?

No—Zipz products are no longer available via their old website or anywhere mainstream.

7. Who owns the Zipz packaging patent?

The original patent was held by Zipz Wine, founded by Andrew McMurray and J. Henry Scott. Current ownership post-closure is unclear.

8. What can entrepreneurs learn from Zipz’s story?

Hype fades. Focus and execution rule. Don’t bet your company on a TV moment—bet it on relentless, customer-first work.

Curious about more Shark Tank outcomes or hungry for hard-won startup lessons? Keep it locked on SharkWorth for real stories behind the showbiz deals.