If you walk into the Shark Tank expecting a fairy tale, you’ve never pitched under those studio lights. Every hopeful founder aims to score a handshake and walk out richer. But the real story starts the second those doors close behind you.

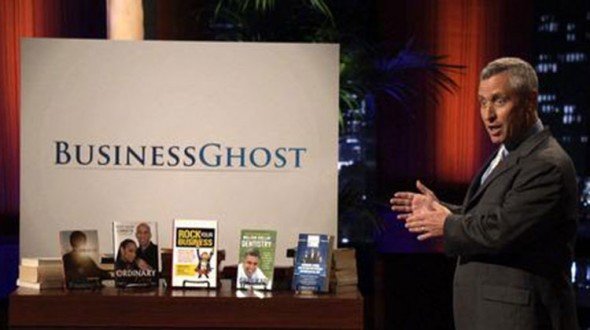

Take Business Ghost—Michael Levin’s ghostwriting company for CEOs and celebrities. On the surface, it looked like a sure thing. Solid profits. Big-name clients. Years of credibility. But if you think that’s enough to reel in Sharks, you haven’t seen how fast they can sniff out risk. I’m here to walk you through this pitch, the aftermath, and the business lessons that don’t show up in the sizzle reel.

Contents

ToggleMeet Business Ghost and Michael Levin

Let’s get the basics straight: Michael Levin isn’t your average freelancer with a laptop at Starbucks. He’s written, co-written, or ghostwritten over 100 books. His clients? Fortune 500 execs, big-time entrepreneurs, and personalities who know their brand is built, in part, on the stories told about them.

Business Ghost wasn’t trying to help every aspiring author. This wasn’t for your aunt’s poetry collection or your neighbor’s next big novel. The whole value prop? Take high-powered, time-starved leaders and give them a book with their name on it—a tool for authority, prestige, and, yeah, ego. Levin positioned himself as the secret weapon behind the men and women you see on magazine covers.

Why’d he go to Shark Tank? Simple: he wanted scale. But as any old-school hustler knows, not all services scale with capital alone.

The Pitch: Stakes, Ask, and Shark Reactions

Season 3, Episode 1. Michael Levin asks for $200,000 for 10% equity. Quick math—he’s valuing Business Ghost at $2 million. For a service business, that’s gutsy. No widgets, no new app, just reputation and recurring deals.

Here’s what he laid out on the table:

- He led a team, not just a solo hustle.

- Track record with big personalities, meaning real cash flow and not just dreams.

- Business Ghost had steady business and enough staff to handle client flow.

The Sharks—Mark Cuban, Kevin O’Leary, Barbara Corcoran, Daymond John, and Robert Herjavec—all paused to listen. No rolling eyes or stifled yawns. They respected his grind but started sniffing for scale, risk, and exit potential. Because let’s face it: nobody on Shark Tank wants a $500K lifetime royalty—they want a bombshell exit.

Each Shark clocked the challenge. Service-based, reputation-driven, and a founder-led operation. They know: you, not the product, are what’s on the line.

Business Ghost Net Worth: What’s the Real Value?

On TV, the $2 million valuation sounded like a stretch for a ghostwriting agency—unless you’re used to SaaS multiples and blue-sky projections. But Levin had something most service businesses don’t: steady, high-fee contracts from the kind of clients who don’t price shop. That’s leverage. It’s also risky. Lose one client, and your next quarterly numbers tank.

The truth? The real value of Business Ghost was less about revenue and more about reputation. After Shark Tank, the SharkWorth (as any founder on the post-show circuit will tell you) often gets a bump—media attention, new inbound leads, speaking gigs, maybe a consult with a CEO who saw you on TV. It’s short-lived unless you reinvest fast.

So, did Business Ghost hit the $2 million mark after Shark Tank? Not on paper. The business saw a short burst of interest, but without a deal and with the same bottlenecks, the big leap never happened.

What Went Wrong in the Tank?

I’ve watched founders pitch service businesses with confidence, but the classic Tank problems always show up. The Sharks smelled each one:

- Scalability: You can hire writers, sure. But can you 10x output without killing quality? Shark skepticism hit the ceiling.

- Founder Dependency: Michael was the brand. Remove him, and the house collapses. That makes investors nervous.

- Repeatability: Products can go viral. Service models climb one staircase at a time. No overnight unicorn play here.

- Clear Strategy for Growth: Robert Herjavec wasn’t joking—if you want $200K, show the rocket fuel plan, not just stable profits.

Each Shark walked, but not from disrespect. In fact, they praised Levin’s hustle. Mark Cuban flagged the challenge of pumping millions into a one-man brand. Barbara Corcoran read his self-deprecating pitch as a lack of confidence—a red flag. Kevin O’Leary respected the margin but saw a risky ceiling. Daymond John wanted his money back, but couldn’t see the path.

I’ve seen it before: service-based models are tough sells unless you crack a system that works without you. The Tank isn’t kind to personal brands unless you’re pitching Mr. Wonderful’s own playbook.

Life After Shark Tank: Did Business Ghost Survive?

Think Shark Tank is the end of the road? It’s just act one. Michael Levin left without a deal, but the limelight didn’t burn him. Instead, he got the post-Tank bounce. Bookings increased, his legend grew, and doors opened that would’ve stayed shut otherwise.

Here’s how he played the aftermath:

- He re-examined the strategy. Could he franchise the Business Ghost model? Automate? License out his processes?

- In 2016, he sold the company to Advantage Media/Forbes Books. That’s not a flaming unicorn exit, but it’s a clean, credible acquisition that gives any entrepreneur breathing room.

- Levin didn’t stop. True hustlers pivot. He founded The Fable Factory and Michael Levin Writing Experience, keeping his client base alive and building brand-new cash streams.

Some founders get lost after a no. Michael doubled down. He bet on his skills, broadened his approach, and kept cashing in on his expertise.

Is Business Ghost Still in Business?

Here’s the straight answer every SharkWorth reader wants: No, Business Ghost, as it appeared on Shark Tank, is no longer operating as an independent business. The website’s gone, and the service has been folded under the Forbes Books umbrella since 2016.

Still, Levin is far from retired. He’s writing, consulting, and churning out content on his own terms. If you want to hire him? You’ll find him, but not through the old Business Ghost site. Check out his newer ventures.

This is classic post-Tank playbook: Sell, rebrand, move upstream, and keep your seat at the table.

Final Take: Lessons from the Business Ghost Journey

There’s real genius in knowing your limits. Michael Levin knew his business, his numbers, and, importantly, his personal value. But in the Tank, you’re not just selling dollars—you’re packaging the whole machine for scale.

Service-first businesses rarely make great Shark deals unless you’ve cracked automated revenue or can operate independently. The Sharks didn’t bite, but that wasn’t a loss—it was a signal. Michael saw the writing on the wall and pivoted, switching up his exit plan and scoring an acquisition instead of a spotty equity partner.

If I’m blunt, here’s the lesson for every hustler reading this:

- Know when your business is you, and when it’s a system. Scalability isn’t just about more clients; it’s about building something that lives beyond your hustle.

- Don’t worship at the altar of the Sharks. A televised no isn’t failure. Sometimes it’s a billboard that brings the right buyer.

- If you’re a founder, take the free marketing, retool your approach, and pitch again. Whether you land a deal or not, keep moving.

Most pitch stories start and end at the ask. The real operators—like Michael Levin—know the lights don’t matter. It’s the moves you make after the curtain falls that decide your future.

FAQs

1. Is Business Ghost still in business after Shark Tank?

No, not as an independent company. Business Ghost was acquired by Advantage Media/Forbes Books in 2016.

2. Did Michael Levin ever secure funding from another investor?

He didn’t go public with another investor deal. Instead, he sold the business and launched two more ventures.

3. Why did the Sharks reject the Business Ghost deal?

Service businesses, especially those based on one person’s skill, are tough to scale. That scared off the Sharks.

4. What kind of clients did Business Ghost serve?

High-profile CEOs, financial moguls, business leaders, and a few celebrities—the type who want their stories written but not by themselves.

5. Was Business Ghost profitable before Shark Tank?

Yes, the company had consistent revenue and Levin was cashing solid checks from prominent clients.

6. What happened to Michael Levin after Business Ghost?

He sold Business Ghost, then founded The Fable Factory and Michael Levin Writing Experience, still specializing in ghostwriting.

7. Who owns Business Ghost now?

Advantage Media/Forbes Books owns the brand after acquiring it in 2016.

8. Can anyone still hire Michael Levin for ghostwriting?

Yes, but you’ll have to find him through his new platforms—he’s still working with select clients who can pay his rates.

Business Ghost’s run on Shark Tank reminds us: TV is exposure, not destiny. The best hustlers write their own next chapter.