Here’s the thing about Shark Tank: not every buzzy pitch lands a real business win. So what happens when the cameras cut and you still have to make payroll? Numilk wasn’t just another almond milk brand hoping for a viral bump. They swung big, betting on fresh plant-based milk made-to-order — and a valuation that would make most investors raise an eyebrow. Did they pull a Scrub Daddy and stick, or fizz out like so many before them? Let’s cut through the noise and look at what really went down.

Contents

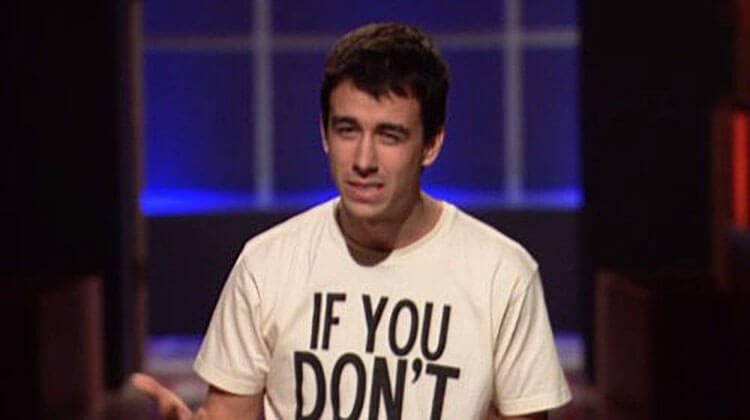

ToggleMeet the Founders: Joe Savino and Ari Tolwin

Numilk wasn’t built by hobbyists hoping to ride a vegan trend. Joe Savino and Ari Tolwin knew the beverage grind. Here’s their real-world pedigree:

Ari Tolwin cut his teeth as the co-founder and CEO of Happy Tree Maple Water. If you’ve ever tried to get a beverage onto grocery shelves, you know that’s not a job for the timid. Joe Savino built and co-founded Harvest Beverage Group — a provider for other beverage brands needing production muscle. He’s got the operator’s mindset and credits himself for inventing the Numilk machine.

These guys weren’t tourists. They’d both taken swings in the drinks business and brought hard-won fuzziness: how to build, scale, and fight for shelf space.

The Pitch: Big Ask, Bold Play

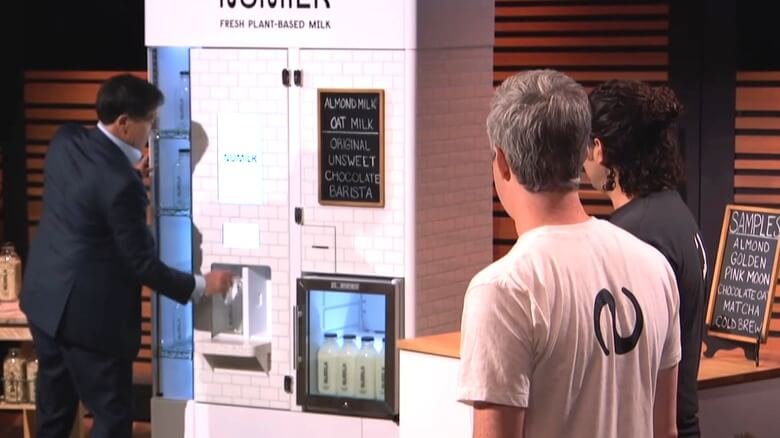

Shark Tank, Season 12, Episode 18. Joe and Ari stepped into the Tank with one of the gutsiest asks I’ve seen: $1 million for 5% equity. That’s an eye-watering $20 million valuation for a company not yet eating Oatly’s lunch. But they had a showstopper machine and a mission to kill food waste and bring fresher, cheaper plant-based milk to stores and homes.

When founders throw out numbers like that, the air shifts. The Sharks sit up. Investors who’ve been around always ask: Are you selling sizzle or steak? Joe and Ari claimed both — with a prototype for a Keurig-style home device and proof their kiosk version was already churning in some Whole Foods locations.

It was confident. Risky. But sometimes that’s the exact move you need to snap the Sharks awake

Net Worth: Where the Real Money Is

Let’s get real — valuations matter, but so does the backstory. By the time they hit Shark Tank, Numilk had raised $12 million. But here’s where it gets dicey: $7 million was already gone, mostly for R&D. Anyone who’s scaled hardware knows prototypes eat cash. Still, that burn rate would make any investor reach for the antacids.

With a $20 million valuation, you better have more than flashy tech — you need traction, moats, and a brand story people tattoo on their forearms. Was Numilk there yet? Not quite. But the offer showed the founders understood negotiation, making space for a counter while not blinking first.

In the end, Mark Cuban’s deal landed at $2 million: one million for 7% equity, and a million-dollar loan with a low 3% interest, plus 3% of the company tacked on. If you’re doing the math, that’s more capital and more dilution — but also less expensive debt than O’Leary’s 9.5% proposal. It was a classic know what you’re worth, but don’t be dumb greedy play.

Sharks React: Who Bit, Who Balked, and Why

Let’s call this what it was: a table-splitter. Some Sharks loved the taste. Barbara Corcoran basically said, Store-bought can’t compete. But when Joe and Ari dropped the numbers, red flags shot up.

Kevin O’Leary — Mr. Wonderful himself — flinched at the hardware costs, saying kiosks are a bear to manufacture, service, and scale. Lori Greiner, Daymond John, and Barbara bowed out, citing concerns that the financials just didn’t shake out in the short-term.

But Cuban? He smelled disruption. He already bet big on plant-based and knew high-cost tech can still win — if you own a unique wedge. His deal wasn’t charity; it was faith that fresh, made-at-the-point-of-sale milk could build loyalty the way Coke once turned soda fountains into gold.

O’Leary’s offer — a classic Shark move — added real risk with steep debt. The founders played it smart, leveraging two bids for a better package. That’s how you run a pitch.

Products: What Numilk Actually Sells (And Why You’d Pay Up)

Don’t mistake Numilk for an overhyped blender. This machine cranks out fresh almond milk (or oat, macadamia — pick your nut) in 30 seconds, with only water, nuts, and maybe a splash of maple syrup. No gums, no shelf stabilizers, no wasted cartons.

The store model is a kiosk: think a self-serve coffee bar, but for plant milk lovers in groceries and maybe cafes. The price? $3.99 a bottle — fresher than boxed, without the nasties you can’t pronounce.

Numilk knew groceries wanted to cut food waste and offer plant-based options without a deadweight inventory. Customers get transparency and flavor. Retailers get another way to lock in the new alt-milk shopper.

At the time of their pitch, Numilk was already installed in select Whole Foods and several indie stores in New York and New England. They even dangled a home version — think Nespresso for vegans — which wasn’t fully launched but had prototype buzz.

Expansion Moves: Did Whole Foods and Retail Buy in?

Here’s where so many Shark Tank businesses crash out. Hype is great, but shelf space is war. Numilk claimed expansion-ready partnerships and said Whole Foods wanted a bigger rollout. Plant-based milk was (and still is) on a rocket ride, but big retailers don’t just hand over square footage for wishful thinking.

Initial traction looked real, but I want to see year-over-year growth, not just Shark Tank afterglow. They had plans for more machines and product lines, from oat and macadamia to straight-up customizable blends. Anecdotally, their machines were showing up in more stores after Cuban’s investment, and the home version rollout picked up speed on their website and in crowdfunding.

Did they lock in a nationwide deal? That ship hadn’t fully come in, but momentum was building and Whole Foods liked being on the edge of fresh food trends. Numilk wasn’t an aisle filler yet, but they weren’t getting booted to the endcap graveyard, either.

Is Numilk Still a Player?

Straight talk — the TV win got them a cash and buzz boost. But did it translate? As of the last check, Numilk had expanded its partnerships and kept the home unit journey moving. Their public marketing still pushes quality, less waste, and the hands-on DIY angle.

Hardware startups are always risky. The margins are only great when you scale, but you need capital to reach that scale. Numilk has had to outlast supply chain snarls, evolving plant-based tastes, and competing tech.

Are they as hot as they were the week after Shark Tank? Not quite. Have they faded to zero? Not by a long shot. Their machines still stand in premium grocers, and their website is active and selling. Mark Cuban’s reputation for backing real plays isn’t just marketing — he tends to prune losers from his portfolio. As long as Numilk hustles expansion and innovation (watch that home model), they still have a seat at the plant milk table.

Conclusion: Lessons from Numilk’s Shark Tank Story

Numilk played the high-valuation, high-drama game well. They brought receipts with hard-won industry experience, knew where their blind spots were, and didn’t blink when the Sharks grilled their burn rate.

Here’s what side hustlers, founders, or investors can take from their run:

- If you ask for a premium, show the value. Don’t expect a pat on the head for disruption.

- Real traction beats pretty decks. Retail landings, even in one region, matter more than viral videos.

- Know your numbers and own your past mistakes. The Sharks sniff out wishful thinking in seconds.

- Don’t get greedy in negotiations. Sometimes the best deal is the one that gives you actual runway and support.

- Even if you win TV money, the grind after matters more. If you can’t scale, post-Shark Tank glow fades fast.

Most businesses never get a Shark. Even fewer keep their post-show promises. Numilk hasn’t turned into the next Scrub Daddy yet, but if they play their cards right, they could still rewrite the milk game.

For the full lowdown on Numilk’s net worth, deal details, and updates, check out SharkWorth — the spot where real numbers, not just reality TV spin, get broken down.

FAQs

1. Who owns Numilk now?

Numilk is still owned by founders Joe Savino and Ari Tolwin, with Mark Cuban holding a significant stake from his Shark Tank deal.

2. Is Numilk still in business after Shark Tank?

Yes, Numilk is still operating. Their machines are in select stores, and the home version is available for order online.

3. What did Mark Cuban invest in Numilk, and did the deal close?

Mark Cuban agreed to a $2 million package: $1 million equity and $1 million loan, plus additional stock. He has since remained engaged with the company.

4. How much is Numilk worth today?

Numilk’s latest public valuation, post-Shark Tank, was around $20 million. Actual market value may fluctuate based on recent sales and expansion.

5. Where can you actually buy or use Numilk machines?

Find Numilk kiosks in select Whole Foods locations and independent groceries — mostly in the Northeast. The home countertop machine is for sale on Numilk’s website.

6. What problems did the Sharks see with Numilk’s business model?

High kiosk costs, cash burn, and questions about scalability versus off-the-shelf competitors were major red flags during the pitch.

7. Did Numilk launch a home version for consumers?

Yes, they’ve developed and begun shipping a home countertop machine for fresh plant-based milk at home.

8. How does Numilk’s milk compare to store-bought in price and taste?

Numilk’s product is fresher, cleaner, and a bit pricier than shelf brands — but fans say the taste is on another level. If you want minimal ingredients and maximum flavor, it stands out from the boxed crowd.

Want the unfiltered scoop on more post-Shark Tank startups? Bookmark SharkWorth — where we cut through the pitch and show you who’s really winning.